Application of taxes according to HSN code in products

The HSN code needs to be declared on the tax invoice and also to be reported while filing a GST return.

While filing GST returns online, the HSN code (in case of a supply of goods) and SAC (in case of a supply of services) will have to be uploaded and there will be no need to enter the description of goods or services while filing GST returns.

Now we can directly put GST in HSN codes and relevant taxes will be automatically selected whenever needed.

We can create HSN, assign taxes, allot HSN to products and apply taxes in the following way:

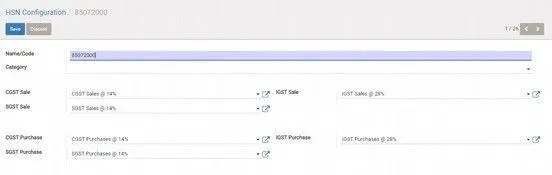

Create an HSN code and assign taxes:

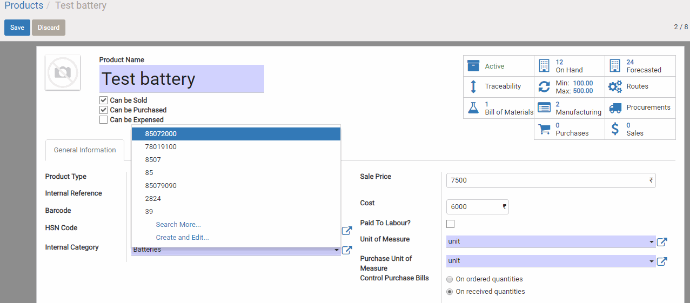

Configure HSN code on products.

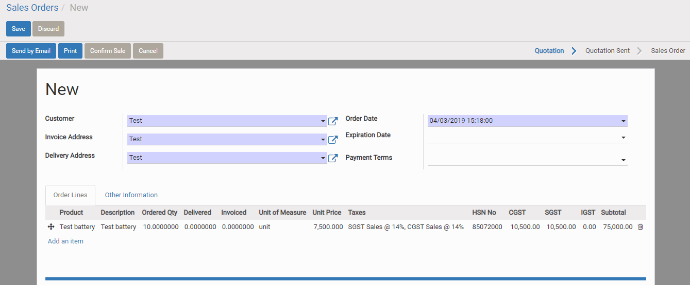

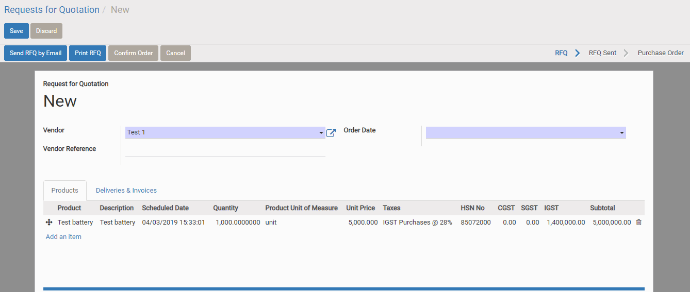

GST application in purchase orders:

Intrastate purchase:

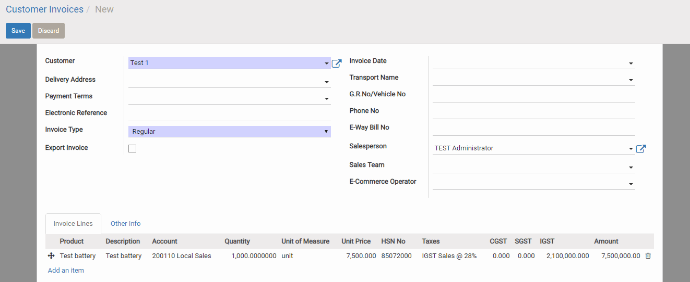

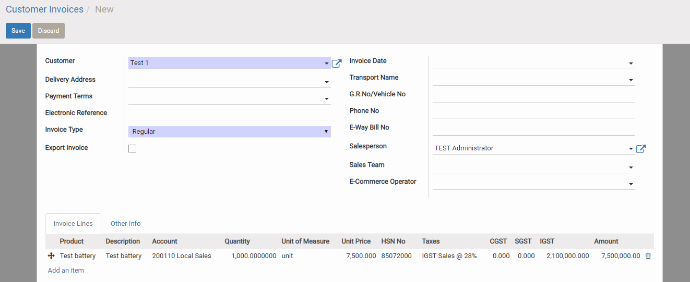

GST application in invoices:

Invoice for intrastate transaction.

So, now it is seamless to apply and use HSN codes as all we need to do is configure the HSN code in the product itself and the system is smart enough to apply appropriate taxes according to the HSN code and partner state.

For any query or to get this module please contact us at info@geotechnosoft.com